In Their Own Words

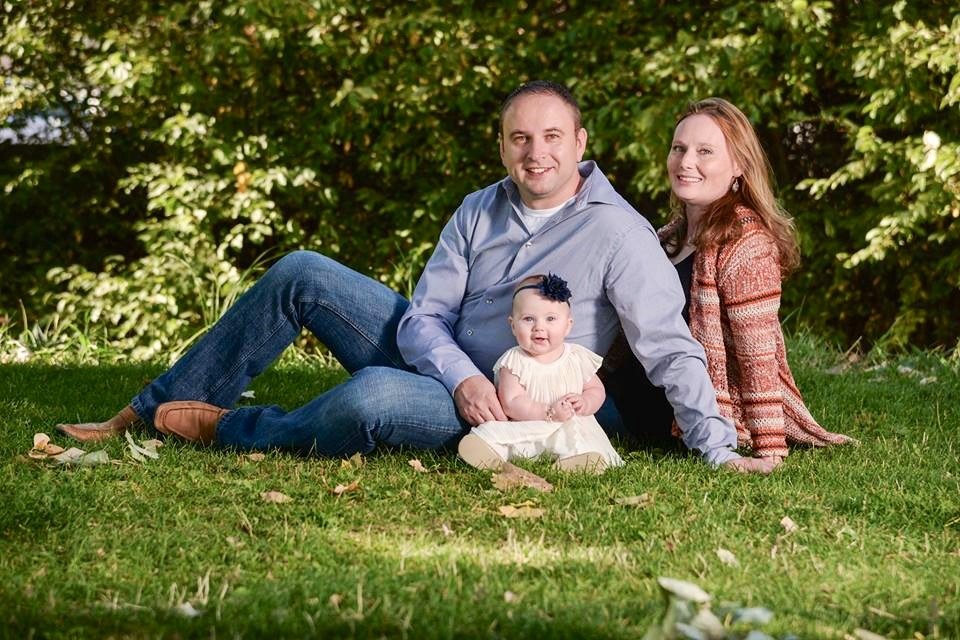

Velma Donahue-Sandberg,

Widow of Trooper Cody Donahue

End of Watch: November 25, 2016

The current state law on workers’ compensation benefits states that: If you are a state employee and you lose a spouse in the line of duty (while at work) the death benefits shall be paid to a dependent widow or widower for life or until remarriage. How does that make sense? If you get remarried, you don’t receive benefits any longer? Is someone supposed to suddenly be grief-free and financially wealthy just because they got remarried? Moving on to the next chapter of your life, such as remarriage, doesn’t mean everything is perfect and you no longer need support. This law needs to be changed immediately, so that even if you remarry, you are still entitled to receive those benefits.

Right now, at the state capital, we have support from House Rep. Sheila Lieder (D-Littleton) and Rep. Ryan Armagost (R-Berthoud), Sen. Perry Will (R-New Castle) and Sen. Tony Exum (D-Colorado Springs) to make a change so that the benefits do not end if you get remarried. I am very thankful for their support in this and pray that the bill does pass. For those of us who have lost a loved one in the line of duty, moving on is a very difficult process emotionally, physically, and financially. I lost my husband Trooper Cody Donahue on November 25th, 2016. The most difficult day of my entire life was when I received the news that he was killed. If receiving the news wasn’t horrible enough, telling my two young daughters, then ages 7 and 10, that their daddy isn’t coming home is the most painful thing I have ever had to do. Grief stays with us forever, and we live in pain for the rest of our lives. The loss never goes away, and as years go on, you are reminded of that loss even more on any monumental occasion such as birthdays, anniversaries, holidays, graduation, getting married, having kids, etc. You unwillingly become a member of the club that no one ever wants to be in.

When you lose a spouse who worked for the state in the line of duty, you learn that when it comes to receiving benefits, you will receive about 70% of their monthly pay. You will also receive some workers’ comp benefits until you get remarried or die. Personally, the idea that the benefits stop when you get remarried is absurd. No one should have the right to tell you if you can get remarried or not. There shouldn’t be in any way a financial penalty for moving on. Why does the state and workers’ comp think that just because someone gets remarried, they no longer need financial support?

Your loved one is gone forever, and now you are being told, “Wonderful, you are getting remarried and now you are someone else’s problem and not ours.” Just because you move on and start a new family doesn’t mean your loss has stopped being painful, that your finances have suddenly and drastically improved overnight; and that you no longer have the right to receive something you are entitled to. My Cody was a huge provider, the primary provider for our family. His salary was our primary source of income, and I am sure many other families are like that.

Trooper Cody Donahue

The workers’ comp funds were technically allocated to you from the moment your spouse died, and they should continue to be available for the rest of your life. This doesn’t cost workers’ comp any more money than it has. The money is there and if you can receive it until death why can’t you receive it even if you get remarried? All it’s doing right now is punishing widows and widowers from moving on in remarriage. If they stay single, they can continue receiving benefits until death, but why deny them the right to remarry and continue moving on? How is that right?

What we are asking for is that the workers’ comp and the state do not control marriage and moving on for the families who have given up and lost so much already. These families need support for the rest of their lives whether it’s financially or emotionally. They will never be the same and punishing them financially for getting remarried is inconceivable. Haven’t they lost enough already? Remarriage doesn’t mean that you are no longer financially responsible and that now it’s your new spouse’s responsibility to take care of you. That is not fair to them or the new spouse. We are talking about families here, children, widows, and widowers who are going through something so awful that no one should ever have to go through it, and yet the current law is trying to control their moving on and healing process by financially holding them hostage. We need this law to change, and we need it now.

DJ Jursevics,

Widower of Trooper Jaimie Lynn Jursevics

End of Watch: November 15, 2015

I believe I have a somewhat unique insight on HB 1139 being a widower of a CSP Trooper. Thank goodness there are relatively few of us in this position. The current workers’ compensation law directly impacts the quality of care for the minor children of the Trooper killed in the line of duty. It’s essentially incentivizing the surviving spouse to raise the child (or children) as a single parent for the rest of their life. The child or children are already traumatized and enduring significant emotional and mental stress, along with their sole remaining biological parent.

The current law is fundamentally unfair to a survivor’s potential future life partner. It’s as if the potential future life partner has to be “income qualified” to be in a committed relationship with a survivor. Remarrying is challenging to begin with on multiple levels, without this additional obstacle. It’s marring the prospect of future marriage because of it being a major financial adverse consideration for the family.

The surviving spouse benefits are not a full salary replacement of the deceased person to begin with. This came as a surprise to many of the state patrol cadets I spoke to after Jaimie was killed. It’s also not indexed or adjusted for inflation, so effectively, it’s being reduced every year. In addition, if there is a third-party insurance payment involved, the State will be the very first in line to subrogate the comp claim against it. The workers’ comp survivor benefit is also at least partially reduced if a surviving minor receives SSI (Social Security Income) death benefits.

If the unthinkable happens, as in my case, daily living expenses went up, not down, with the inability to work for over a year and the additional childcare expenses as our daughter Morgan was 8 months old at the time, and we were splitting our time caring for her.

Trooper Jaimie Jursevics

DJ and Jaimie Jursevics with daughter Morgan

Amy Moden,

Widow of Master Trooper William Moden End of Watch: June 14, 2019

On June 14, 2019, my world as I knew it was gone. My husband, Master Trooper William Moden, was killed in the line of duty. That awful night I lost the love of my life, my future, my hope, and my security. Many things run through your mind when you are faced with losing your spouse and partner in life. It’s not just the deep and heavy grief and pain that you feel. You think about life and how you’re going to make it without them, how you’re going to survive. You become very scared, worried, and unsure. Unsure about how you’re going to keep your home, the home that you built your life around and shared. Unsure about how you’re going to pay for your health insurance, and the therapy you need to have due to your tragedy. Worried about how you’re going to pay all the bills. There are so many things you now worry about that you never thought you had to worry about before because they were there to take care of you and help support you. Due to William’s line of duty death, I now receive monthly payments from workers’ compensation that help support me and my obligations. Receiving the benefits has helped relieve some of my financial stress and fears. However, it’s a two-edged sword. On one side, I have the benefit that I can rely on that greatly impacts my life, and on the other side I have a constant worry that I am not able to fully move forward with my life in fear of losing that benefit. Moving on from your loss is not a “thing.” You can’t move on from pain and loss of that magnitude. You learn how to move forward, and I feel like I am not being allowed to fully do that. I feel trapped in my trauma of losing William. If I move forward and allow myself to have someone special come into my life, I risk losing the financial resources that I depend on. I wholeheartedly support HB 24-1139. Currently, with how the law is written, I have to choose between my happiness and my financial security. This bill, if passed, would no longer force me to choose between the two. I could have both. I would have the ability to fully love again and not live a life alone.

William and Amy Moden